The precise formula for determining the payment for your monthly mortgage payments is: We offer the web's most advanced extra mortgage payment calculator if you would like to track how one-off or recurring extra payments will impact your loan. If you pay extra on your loan early into the term it means the associated debt is extinguished forever, which means a greater share of your future payments will apply toward principal.

By the end of your loan term, the majority of each payment will be going toward principle.

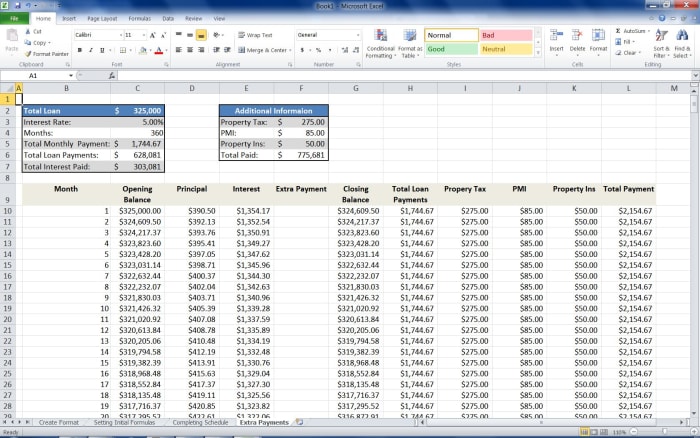

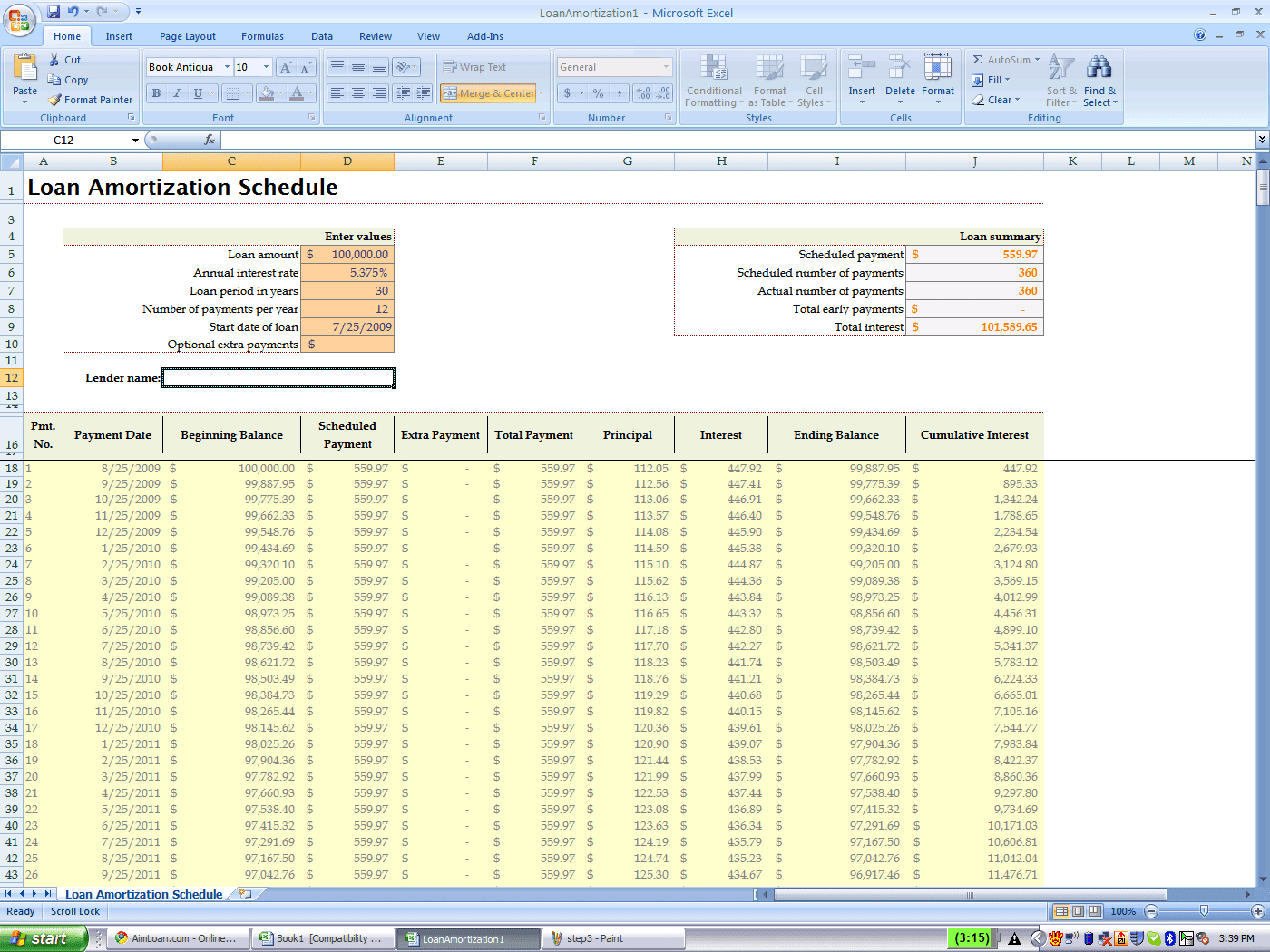

With each successive payment, you are putting in a little more toward principle and a little less toward interest. However, since your loan is structured for equal payments, that means that you're just shifting the ratio, not actually paying less each month. With each payment, you will reduce the principle balance and, therefore, the amount of interest you have to pay. Therefore, at the beginning of your loan, you may owe a couple hundred thousand dollars and will still have a hefty interest charge. The reason that the majority of your early payments consist of interest is that for each payment, you are paying out interest on the principle balance that you still owe. How many months you have already paid in to the loan.The amount that you pay in principle each month depends on a number of variables, including: Even though you may be paying over $1,000 a month toward your mortgage, only $100-$200 may be going toward paying down your principal balance. When you buy your first home, you may get a shock when you take a look at your first mortgage statement: You'll hardly make a dent in your principle as the majority of your payment will apply toward interest. If you want to add extra payments to your loan to pay it off quicker, please use this calculator to see how quickly you will pay off your loan by making additional payments.

MORTGAGE CALCULATOR PMI EXTRA PAYMENTS FREE

Want to see how fast you will pay off your home loan? Use this free calculator to figure out what your remaining principal balance & home equity will be after paying on your loan for a specific number of months or years. If you subtract the $26,733.11 you have paid toward the principal from the original loan amount, this leaves you with $223,266.89 in principal left to be paid.Ĭurrent Remaining Mortgage Principal Calculator After paying on your loan for 60 months, you will have paid $38,547.84 in interest and only $26,733.11 toward the principal. The original loan was for 30 years, but you have already paid on the loan for 60 months. Together, all of these factors will help you figure out the amount of principal you still owe.Īs an example, pretend your total loan was for $250000.00 with a 3.250% interest rate. In order to figure out your remaining balance, you only need to know the loan amount, the interest rate on your loan, the length of your loan, and how many months you have already paid. Your Results in Plain English ( Switch to Financial Analysis)ĭetermining your mortgage loan principal - money you still owe to the bank for your house, can be very beneficial, particularly if you are looking to pay your mortgage off ahead of time.

0 kommentar(er)

0 kommentar(er)